The European Online Payment Gateway Market has witnessed remarkable growth as digital transactions reshape the region's commercial ecosystem. Payment gateways act as intermediaries between merchants and financial institutions, enabling secure, swift, and seamless online transactions. The expansion of e-commerce, the digitalization of banking services, and the increasing adoption of mobile wallets are driving robust growth across multiple applications — from retail and BFSI to healthcare, travel, and education. As European consumers increasingly favor contactless and digital payment methods, application-based segmentation provides valuable insight into evolving market dynamics.

Market Overview

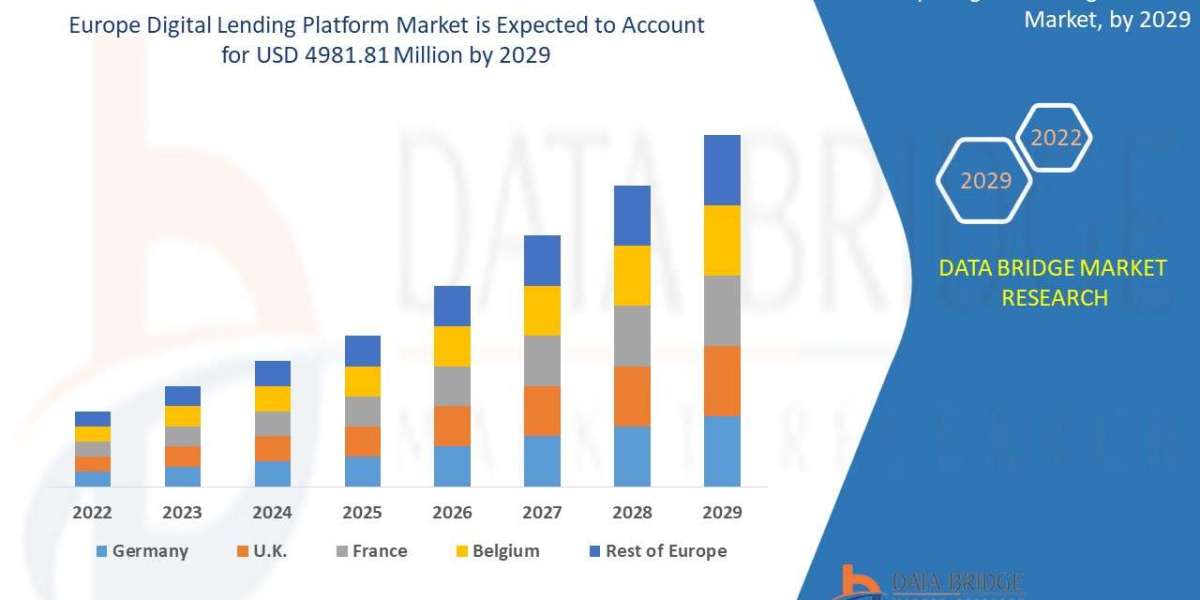

Europe is one of the most mature regions in the global digital payment landscape. The region's online payment gateway market is projected to expand steadily from 2025 to 2035, propelled by the rise of cross-border e-commerce, fintech innovation, and the integration of artificial intelligence in payment infrastructure. According to recent estimates, leading economies such as Germany, the UK, France, and the Nordics are at the forefront of adoption, supported by strong regulatory frameworks such as PSD2 (Payment Services Directive 2) and the European Data Protection Regulation (GDPR).

The application-based segmentation of the market reveals how specific industries are leveraging payment gateways to improve transaction efficiency, customer experience, and security.

1. E-Commerce Application

The e-commerce sector dominates the European online payment gateway market by application share. Consumers' preference for online shopping, driven by convenience and diverse product availability, has accelerated the need for secure payment processing. Payment gateways such as Stripe, Adyen, PayPal, and Klarna are enabling real-time, multi-currency payments across European borders. The adoption of “buy now, pay later” (BNPL) options and digital wallets like Apple Pay and Google Pay further enhance the e-commerce checkout experience.

Retailers benefit from streamlined operations, fraud prevention tools, and data analytics capabilities integrated within these gateways, ensuring customer trust and retention.

2. BFSI (Banking, Financial Services, and Insurance)

The BFSI application segment is witnessing major transformation as traditional banks collaborate with fintech firms to offer seamless digital payment solutions. Online gateways are critical for processing credit card payments, fund transfers, insurance premiums, and investment-related transactions. The integration of biometric authentication, tokenization, and advanced encryption in gateways helps financial institutions comply with stringent European security standards.

This sector’s focus is on secure digital identity management and real-time settlement systems, which enhance efficiency and reduce transaction friction across digital banking platforms.

3. Travel and Hospitality

Europe’s tourism and hospitality industry heavily relies on online payment gateways for booking, reservations, and ticketing services. With millions of travelers booking hotels, flights, and activities online, gateways enable safe cross-border payments in multiple currencies. Companies such as Booking.com, Expedia, and local travel portals integrate advanced gateways to reduce cart abandonment and improve customer trust.

The rise of digital wallets and mobile apps also facilitates instant refunds and cancellations — essential for maintaining customer loyalty in a dynamic post-pandemic travel environment.

4. Healthcare

Digital transformation within Europe’s healthcare sector is fueling growth in payment gateway applications. Patients can now pay for telemedicine consultations, online prescriptions, and hospital services through secure payment interfaces. Payment gateways ensure compliance with data protection and confidentiality laws, which is critical when dealing with sensitive patient information. The healthcare application is expected to expand rapidly as medical providers increasingly adopt e-commerce-style platforms for booking and billing services.

5. Education

The education sector is embracing online payment gateways to handle tuition fees, e-learning subscriptions, and course enrollments. Universities and online learning platforms such as Coursera, Udemy, and regional education portals utilize gateways that support recurring payments, multiple currencies, and flexible billing. The digitization of academic payments reduces administrative costs and improves accessibility, particularly for international students studying across Europe.

Market Drivers

- Rising Adoption of Digital Payments: The shift toward cashless economies and government support for electronic payments continue to drive demand across applications.

- Security and Compliance Frameworks: Regulations like PSD2 and GDPR enhance consumer confidence and encourage adoption.

- Technological Advancements: Integration of AI, blockchain, and tokenization strengthens transaction security and efficiency.

- Cross-Border Commerce: The Schengen zone and unified market policies support frictionless digital trade, driving payment gateway usage.

Key Market Trends

- Expansion of BNPL and Subscription Models: Particularly strong in retail and education sectors.

- AI-Driven Fraud Detection: Improves transaction verification and reduces chargebacks.

- Contactless and Mobile Payments: Widespread adoption in Europe's retail and travel industries.

- Rise of Local Payment Systems: Growth of Sofort, Giropay, and iDEAL reflects regional preferences.

- Open Banking Integration: Encourages interoperability among banks, merchants, and third-party providers.

Regional Analysis

- Western Europe: The UK, Germany, and France dominate due to high e-commerce penetration and advanced fintech ecosystems.

- Northern Europe: Nordic countries lead in digital wallet and mobile payment adoption, driven by strong tech infrastructure.

- Southern Europe: Spain and Italy are rapidly digitalizing payments through fintech collaborations and government-backed programs.

- Eastern Europe: Emerging markets such as Poland and Romania are seeing fast adoption of payment gateways due to the rise of online retail and improved internet connectivity.

Challenges and Constraints

Despite robust growth, several challenges persist:

- Cybersecurity Risks: Increasing online fraud and phishing attacks threaten consumer trust.

- Regulatory Complexity: Varying interpretations of EU regulations across countries complicate cross-border transactions.

- High Transaction Fees: Smaller merchants face challenges due to gateway charges and integration costs.

- Limited Adoption in Rural Areas: Uneven internet infrastructure hinders full digital inclusion.

Opportunities

- Integration with Cryptocurrency Payments: Emerging gateways are exploring blockchain-based settlements.

- Expansion of Embedded Finance: Payment gateways can embed financing and lending solutions within merchant apps.

- SME Digital Transformation: Small and medium enterprises adopting digital tools create new growth avenues.

- AI and Data Analytics: Using real-time analytics to enhance customer experience and reduce risk.

Conclusion

The European Online Payment Gateway Market by Application reflects the continent's broader digital transformation. As technology reshapes how individuals and businesses transact, each application — from e-commerce to BFSI, travel, healthcare, and education — plays a distinct role in driving market momentum. With innovation, compliance, and security at its core, Europe's payment gateway ecosystem is set to become a model of efficiency and trust for global digital commerce.