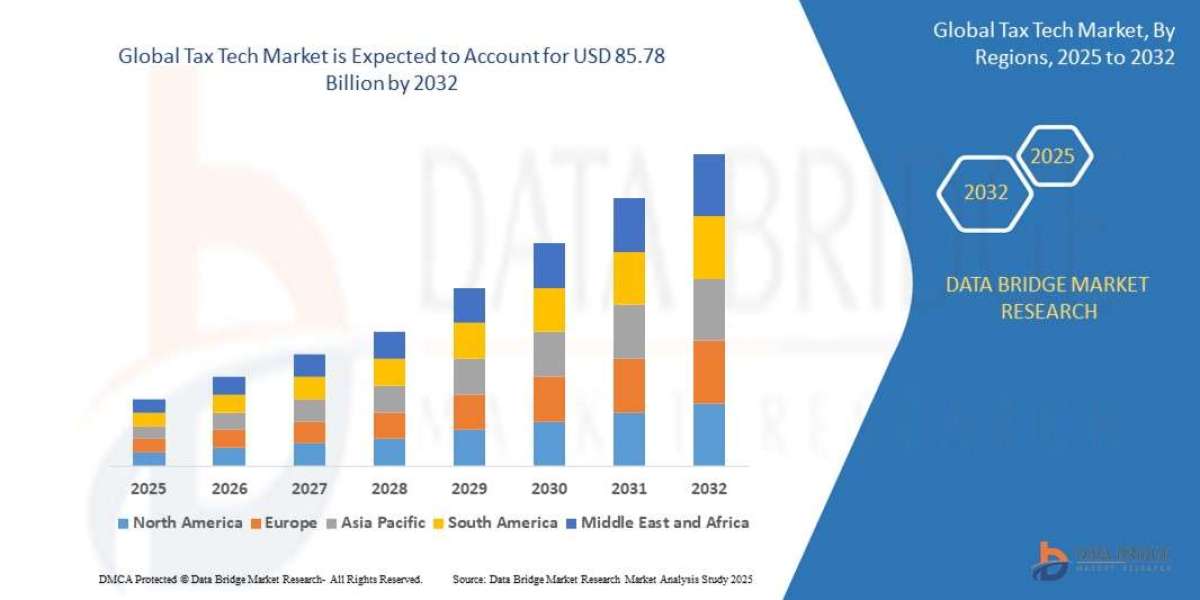

"Comprehensive Outlook on Executive Summary Tax Tech Market Size and Share

CAGR Value

The global tax tech market size was valued at USD 34.4 billion in 2024 and is expected to reach USD 85.78 billion by 2032, at a CAGR of 12.10% during the forecast period

The Tax Tech report includes a range of inhibitors as well as driving forces of the market which are analysed in both qualitative and quantitative approaches so that readers and users get precise information and insights about Tax Tech Market industry. Statistical data mentioned in the report is symbolized with the help of graphs which simplifies the understanding of facts and figures. The Tax Tech report helps define commerce strategies for businesses of small, medium, and large sizes. The analysis and estimations conducted via this report help to get an idea about the product launches, future products, joint ventures, marketing strategy, developments, mergers and acquisitions, and effect of the same on sales, marketing, promotions, revenue, import, export, and CAGR values.

The Tax Tech report makes you knowledgeable about the Tax Tech Market industry and competitive landscape which supports you with enhanced decision-making, better management of marketing of goods and decide market goals for better profitability. All the statistical data and information involved in this report is characterized properly by using several charts, graphs or tables. The report provides strategically analyzed market research analysis and observant business insights into the most relevant markets of our clients. This Tax Tech Market research report helps clients recognize new opportunities and most important customers for their business growth and increased revenue.

Access expert insights and data-driven projections in our detailed Tax Tech Market study. Download full report:

https://www.databridgemarketresearch.com/reports/global-tax-tech-market

Tax Tech Industry Snapshot

Segments

- By Offering: The tax tech market can be segmented based on the offering into software and services. The software segment includes solutions such as tax management software, tax preparation software, and tax calculation software. On the other hand, the services segment comprises consulting, implementation, and support services related to tax technology.

- By Tax Type: Another way to segment the market is by tax type, which includes direct tax and indirect tax. Direct tax refers to taxes directly paid by individuals or organizations to the government, such as income tax and corporate tax. Indirect tax, on the other hand, is imposed on the supply of goods and services, like value-added tax (VAT) and goods and services tax (GST).

- By Deployment Mode: The market can also be categorized based on deployment mode into cloud and on-premises. Cloud-based tax technology solutions are gaining popularity due to their scalability, flexibility, and cost-effectiveness. On-premises solutions, although traditional, are still preferred by some organizations for data security and compliance reasons.

- By End-User: The end-user segment includes small and medium-sized enterprises (SMEs) and large enterprises. SMEs often opt for tax tech solutions to streamline their tax processes and ensure compliance with regulations, while large enterprises require more sophisticated solutions to manage complex tax requirements across multiple jurisdictions.

Market Players

- Vertex, Inc.: Vertex is a leading provider of tax technology solutions that help businesses automate and simplify their tax processes. The company offers a wide range of software and services to meet the needs of different industries and jurisdictions.

- Thomson Reuters Corporation: Thomson Reuters provides tax technology solutions that enable organizations to manage their tax obligations efficiently and accurately. The company's offerings include tax research tools, compliance software, and consulting services.

- Avalara, Inc.: Avalara is a cloud-based tax compliance company that offers automation solutions for transaction tax, including sales tax, VAT, and excise tax. The company's platform integrates with ERP and e-commerce systems to provide real-time tax calculations and filing.

- Wolters Kluwer N.V.: Wolters Kluwer provides tax and accounting software solutions that cater to professionals in various industries. The company's offerings include tax preparation software, research tools, and compliance solutions for global businesses.

DDDDDThe tax technology market is witnessing significant growth driven by the increasing complexity of tax regulations, the need for automation and efficiency in tax processes, and the rising demand for real-time tax compliance solutions. One key trend shaping the market is the integration of artificial intelligence and machine learning capabilities into tax tech solutions to enhance accuracy, speed, and predictive analytics. These technologies enable organizations to improve tax planning, forecasting, and risk management, leading to better decision-making and compliance.

Another important factor influencing the market is the shift towards digital transformation in tax functions, with businesses looking to digitize their tax processes, leverage data analytics for tax insights, and enhance collaboration between tax and other departments. This trend is driving the adoption of cloud-based tax technology solutions that offer scalability, agility, and remote accessibility, especially in the wake of the COVID-19 pandemic that accelerated the demand for remote work capabilities.

Furthermore, the increasing focus on sustainability and corporate social responsibility is leading to the development of tax tech solutions that help companies assess and manage their tax implications related to environmental, social, and governance (ESG) factors. These solutions enable organizations to align their tax strategies with their sustainability goals, comply with evolving ESG reporting requirements, and mitigate risks associated with tax controversies and reputational damage.

Additionally, regulatory changes and geopolitical developments are prompting businesses to invest in tax technology solutions that can address cross-border tax challenges, transfer pricing regulations, import/export duties, and tax compliance in multiple jurisdictions. As governments worldwide continue to introduce new tax laws and reporting requirements, the demand for agile and adaptable tax tech solutions is expected to rise, driving innovation and competition among market players.

Moreover, the growing awareness among businesses about the strategic value of tax technology in optimizing tax processes, managing tax risks, and enhancing overall business performance is fueling the adoption of advanced tax tech solutions. By leveraging integrated tax technology platforms that offer end-to-end tax management capabilities, organizations can streamline their tax operations, improve decision-making, and achieve operational efficiencies that contribute to their bottom line.

In conclusion, the tax technology market is poised for continued growth and innovation as businesses seek to navigate the evolving tax landscape, enhance compliance, improve operational efficiency, and drive strategic value from their tax functions. By embracing emerging technologies, digital transformation, sustainability initiatives, and regulatory changes, organizations can position themselves for success in an increasingly complex and dynamic tax environment.The tax technology market is currently experiencing significant growth and transformation driven by various factors such as the increasing complexity of tax regulations, the need for automation and efficiency in tax processes, and the rising demand for real-time tax compliance solutions. One of the key trends influencing the market is the integration of artificial intelligence (AI) and machine learning capabilities into tax tech solutions. These technologies enhance accuracy, speed, and predictive analytics, enabling organizations to improve tax planning, forecasting, and risk management. By leveraging AI and machine learning, businesses can make better decisions and ensure compliance with tax regulations.

Moreover, the shift towards digital transformation in tax functions is reshaping the market dynamics. Businesses are increasingly looking to digitize their tax processes, utilize data analytics for tax insights, and enhance collaboration between tax and other departments. This digital transformation trend is propelling the adoption of cloud-based tax technology solutions that offer scalability, agility, and remote accessibility. The COVID-19 pandemic has further accelerated the demand for remote work capabilities, driving more organizations towards cloud-based tax solutions for seamless operations and remote access.

Additionally, the growing emphasis on sustainability and corporate social responsibility is leading to the development of tax tech solutions that help companies assess and manage their tax implications related to ESG factors. These solutions enable organizations to align their tax strategies with sustainability goals, comply with evolving ESG reporting requirements, and mitigate risks associated with tax controversies. The focus on sustainability is not only a regulatory requirement but also a strategic imperative for businesses looking to enhance their reputation and contribute positively to society and the environment.

Furthermore, regulatory changes and geopolitical developments are pushing businesses to invest in tax technology solutions that can address cross-border tax challenges, transfer pricing regulations, import/export duties, and tax compliance in multiple jurisdictions. The dynamic nature of tax laws globally necessitates agile and adaptable tax tech solutions that can keep pace with changing requirements. The demand for innovative tax tech solutions is expected to rise as governments introduce new tax regulations and reporting standards, creating opportunities for market players to differentiate their offerings and provide value-added services.

In conclusion, the tax technology market is entering a phase of rapid evolution and innovation as businesses recognize the strategic importance of tax technology in optimizing operations, managing risks, and driving business performance. By embracing emerging technologies, focusing on digital transformation, integrating sustainability initiatives, and staying abreast of regulatory changes, organizations can position themselves for success in a complex and dynamic tax landscape. The market is ripe with opportunities for innovative solutions that can address the evolving needs of businesses in a rapidly changing tax environment.

Discover the company’s competitive share in the industry

https://www.databridgemarketresearch.com/reports/global-tax-tech-market/companies

Market Intelligence Question Sets for Tax Tech Industry

- How big is the current global Tax Tech Market?

- What is the forecasted Tax Tech Market expansion through 2032?

- What core segments are covered in the report on the Tax Tech Market?

- Who are the strategic players in the Tax Tech Market?

- What countries are part of the regional analysis in the Tax Tech Market?

- Who are the prominent vendors in the global Tax Tech Market?

Browse More Reports:

Global Finger Splint Market

Global Fluoropolymer in Healthcare Market

Global Fogless Mirrors Market

Global Food Acidity Regulators Market

Global Halogen Biocides Market

Global Heating, Ventilation, and Air Conditioning (HVAC) Filters Market

Global Heavy Duty Paper and Multiwall Shipping Sack Market

Global Homogeneous Charge Compression Ignition (HCCI) Market

Global Household Clothes Steamers and Dryers Market

Global Hunting Apparel Market

Global Hyaluronidase Deficiency Market

Global Hygiene Adhesives Market

Global Industrial and Commercial Floor Scrubbers Market

Global Industrial Radiography Market

Global Infused Fruits Jellies Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

"